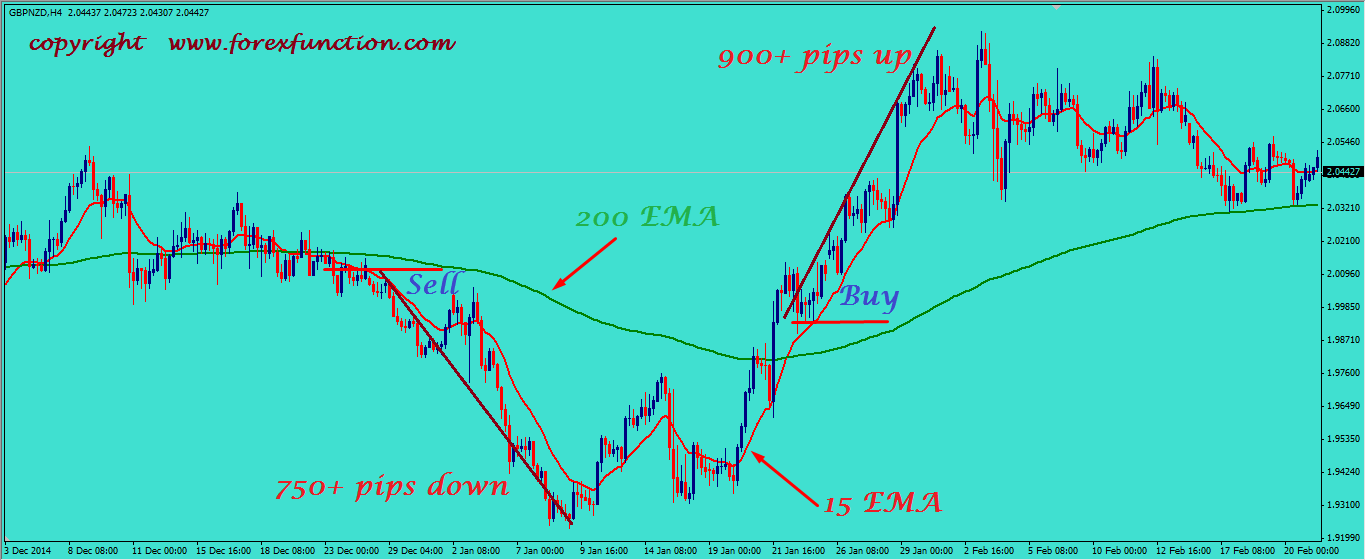

They are not useful when a stock price is going sideways. They are only good with strong trends that are going up or down.They are based only on historial data (trends).

Ma vs ema stock how to#

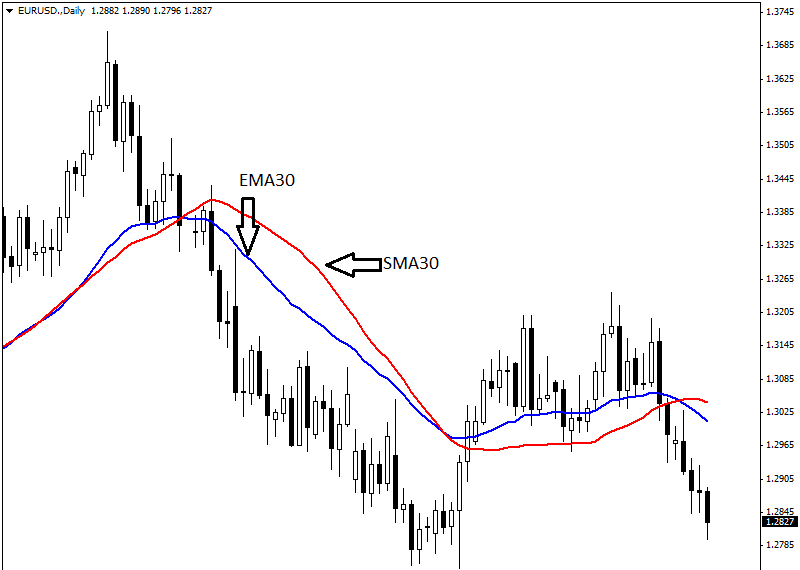

Other tools that I’ll explain soon, including crossovers, ceilings, and floors.īefore getting into how to use moving averages to buy and sell stocks, it’s important to know that they have some disadvantages:.Longer SMAs can show “support” for what the lowest price of a stock should theoretically be, i.e., its “floor.”.A falling MA indicates a downtrend (price decrease, or bear).A rising MA indicates an uptrend (price increase, or bull).Short-term SMAs (5 to 20 days) show short-term trends, and long-term SMAs (20 to 200 days) show long-term trends. They filter out the “noise” of stock price fluctuations.The general advantages of MA values - the reasons they exist - are: EMAs react quicker to price changes than SMAs.The 12- and 26-day EMAs are the most popular short-term averages, and they are used to create indicators like the moving average convergence divergence (MACD) and the percentage price oscillator (PPO).” They later add: “This type of moving average reacts faster to recent price changes than an SMA. This Investopedia page describes EMA like this: “An exponential moving average (EMA) is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data.” Definition: What is a Exponential Moving Average (EMA)? For some purposes it is more useful if the most recent price has a higher weight (more value), and as a result people invented EMAs. So in a 20-day SMA, the stock price from 20 days ago has the same weight as the price yesterday. Note that equal weighting is given to each daily price.”Ī disadvantage of an SMA is that it gives equal weight to all of the prices used to calculate its value. Later they continue: “In other words, this is the average stock price over a certain period of time. Short-term averages respond quickly to changes in the price of the underlying, while long-term averages are slow to react.” With a few edits by me, Investopedia defines SMA like this: “A simple moving average (SMA) is an arithmetic average that is calculated by adding the closing price of the security for a number of time periods and then dividing this total by the number of time periods.

Definition: What is a Simple Moving Average (SMA)? Given that background, here’s what I know about moving averages. Please see the Investopedia pages I link to for much more information. That tells me at a glance that the stock price is trending up.īecause I don’t use moving averages a lot, this page isn’t completely thorough. Recently I have found that they are nice because I can look at a bunch of output from Finviz or other sites, and see that the “20 Day SMA” for a stock is +2.8%. An important idea there is that the “floor price” of a stock using a moving average can be used to set a “stop loss” on a stock.īecause I generally follow the Buffett style of investing I don’t use moving averages as a main tool, but I like to know how they work, and I use them as a way of supporting my other research. Moving averages can be good for people who make a lot of trades, and they can also be used to identify “ceiling” and “floor” prices of stocks. I mention this because I’m about to write about moving averages, and moving averages have nothing to do with a Warren Buffett style of investing.

Conversely, if you wait and buy that model 11 months later - when the next “new” model is about to come out - you’ll be able to buy the same car for a much lower price. If you buy a new car when it’s first introduced, and the model is very popular, the dealer is going to want a lot of money for it. You can think of this strategy as being like buying a new car. The theory is that from time to time, a stock will fall out of favor with the stock market, and when its price gets to a certain low point, it becomes a “value” to buy.

0 kommentar(er)

0 kommentar(er)